If you work on an insurance brand or are generally the curious type, you might find interesting.

We used Auris to listen in to conversations around insurance (July 2019, India only) and let it use its AI to churn insights. Using some of these insights we put together a small trivia for you.

Check whether these observations tally with what you’ve observed or have intuitively believed.

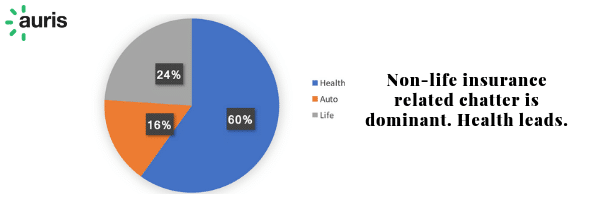

Which insurance vertical is most discussed amongst all insurance verticals?

Health. Amongst conversations in public forums (review boards, social, news boards etc.) – consumers discuss health insurance more than life or auto.

Possibly because the usage frequency of health insurance more than makes up for a relatively lower penetration? Perhaps. The national insurance scheme launched by the Government is spurring a lot more conversation than before.

An interesting correlation is that health insurance is growing faster than other non-life segments and significantly faster than life insurance segment.

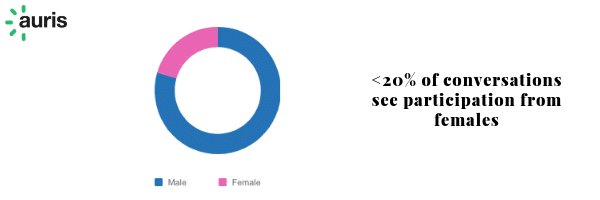

What % of conversations see female participation?

Well, participation is about <20% which is very low.

The decision making as well as a pursuit with agents, customer service is mostly led by the ‘man of the house’ which reflects in the low %.

Any campaign which engages the female audience can open a new segment. Especially, health insurance, because relatively speaking females drive the healthcare portfolio within the family!

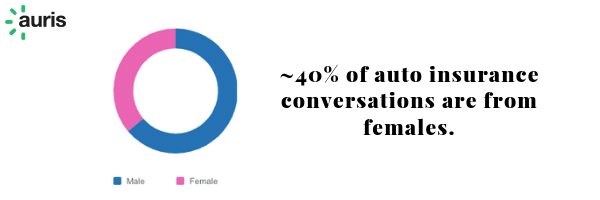

Related to the previous question – conversations around which insurance vertical sees more female participation?

This might be a surprise, but its Auto.

Look around and you’d see a sizeable female population driving as compared to a few years before.

In comparison, life/health insurance responsibility is donned by males, still.

Those thinking brand positioning for auto insurance should do a rethink if their brand does not speak to the female consumer segment.

Look at what forward-thinking insurance brands are doing.

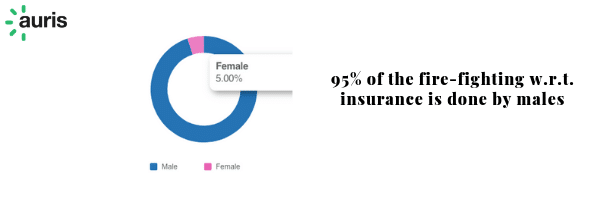

Who’s in charge of dealing with insurance-related issues, i.e., when things go south?

Well, it is predominantly males who do the heavy lifting maneuvering through paperwork, follow-ups and perhaps dealing with some red-tape along the way.

The average NPS scores are low. What drives such low scores?

Misselling & lack of transparency continues to ail the insurance sector overall. Better forms of customer education of what is covered and what’s not are important to win back the trust of the customer.

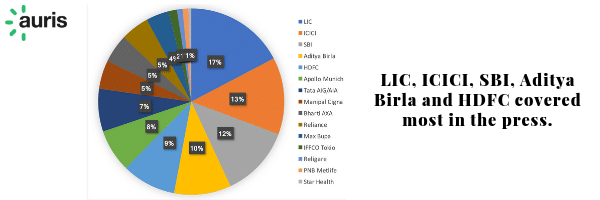

Which Indian insurance brand is most discussed in the news?

No prizes for guessing the #1 J But of course, its LIC!

Closely followed by ICICI, SBI, Aditya Birla, HDFC and Apollo Munich.

Aditya Birla stands out from this set, given the depth and width of the portfolio of the others. Apollo Munich has seen more coverage because of the M&A activity it is engaged in.

Auris for insurance helps unearth such category insights. Auris goes beyond social listening.

Consider using Auris for monitoring your insurance brand and to learn more about consumers, category and competition.